How To Find Working Capital

Startup Business Loans requirements will be taken care of quickly

Startup business loans are just one of the few locations that also the Small company Administration do not use to assist in as well as this comes to be a significant impediment to financial institutions as well as credit unions making this sort of loan offered. Startup Business Loans are a terrific method to launch an effective business. Sadly they are in some cases the hardest to obtain from loan provider.

Yet when it concerns Startup Business Loans, the company informs banks as well as small companies that they are on their very own. That of course not does anything to reassure the banks that fidget sufficient regarding offering fledging businesses any of their hoarded gold as well as it supports the financial institutions' own inclination to not offer Startup Business Loans. So as to get authorization for Startup Business Loans the financial institutions will usually require a personal guarantee from business owner or a pledge of a collateral property to safeguard the loan.

A business will definitely utilize their business acquisition funding to get a business, keep the cost effective divisions and also use its cash and then sell off or perhaps shut the actual less rewarding areas. This unavoidably causes people being dismissed. Business Acquisition Financing can be helpful for the business. It depends on your perspective. Lot of times a company can obtain business acquisition funding not to offer far more product and services to clients. Nevertheless, the same amount or much less.

It is very important that you take a broad view when you promote when you are establishing a business plan. A Debt And Equity Financing strategy need to consist of a malfunction of just how you intend to utilize your funds. SBA loans, unlike equity, calls for regular monthly settlements of principal. Financing resources can be found in a variety of various varieties consisting of SBA loans, angel investors, and also various other exclusive funding resources. Big range businesses might be better of working with a private equity company. Debt funding has primary settlements that are required on a month-to-month basis.

Banks and also other lending institutions locate Franchise Loan less risky since business itself is currently a tried and tested name in the sector. In such a way, individuals requesting a Franchise Loan have the extremely name of the brand name as collateral. But of course, you still have to have the ability to use enough for the loan to be authorized. Right here are some suggestions you might want to comply with:

For beginners, though, you have to be sure that you have adequate funds to finance your venture. All businesses or even function from residence chances need to have the correct amount of funds to back it up. This is why many people assume that companies and also franchising are only for those that have readily available funds. Luckily, there are various choices even for those that do not have enough financial resources to begin with. A rather popular monetary source is a Franchise Loan, which is extra commonly provided by banks.

Whenever getting a small company Acquisition Loan ensure you have all the paperwork that you'll have to present why and exactly how this is a great need to obtain that loan. In a volatile consumer financial market obtaining a local business acquisition loan will certainly not be as straightforward as it was simply a few years earlier. Banking institutions are scrutinizing every application for loans, especially when you are checking out smaller businesses.

Look at this web-site for getting more information related to Startup Business Loans.

Commercial Property Loans

Land And Construction Loans lending market in your area

However financial capacity differs person to person. Those that do not have a correct economic back-up, could get the financial support of Commercial real Estate Loans. Purpose can be anything behind getting Commercial Real Estate Loans. These loans are offered for each sort of loan generating commercial property. It could be office building, shopping mall, resorts, healthcare centre and so forth. Undoubtedly, it can be said that acquiring a business real estate is a costly event. Without a massive financial backing, it is past imagination.

The commercial loan broker could delight in an absolutely uncapped earnings capacity as some of the much better brokers enjoy 7 number earnings, liberty of routine as well as reach work with extremely sophisticated debtors. With these advantages, and also others, it's not a surprise that a lot of domestic loan police officers are making an effort to burglarize business. As a Commercial Loan Broker we could attest to how great of a company this can be.

Some financing business give cause for worry due to the fact that they require repayments in advance to just investigate loans. These firms reject almost all residential properties yet unfairly keep the charges. Customers should work out care and also prevent hard money lenders who ask for substantial costs up front prior to agreeing to fund a project.

The commercial lending entities as a sector operate with excellent speed and also responsiveness, thanks to liberty from federal government laws. This makes it a great alternative for those that seek quick financing. Nonetheless, this has supported a predacious financing wave where most of the business refer loans per various other. This increases the Land And Construction Loans points and also the price each time one describes the various other.

There is additionally great concern regarding the practices of some Property Development Finance firms in the market that call for in advance repayments to check out loans as well as choose not to lend on basically all buildings while maintaining this cost. Debtors are advised not to collaborate with tough money lenders who need outrageous in advance fees before financing. Rather, it is a great idea to search and also interview greater than one loan provider. Figure out exactly what the terms of the loan are and see the suggestions of a professional real estate professional or attorney before authorizing anything relating to the loan.

Commercial Property Loans can be influenced through industrial banks, exclusive loan provider, mutual companies as well as other monetary teams. These loan providers will usually have requirements that vary extensively. Their standards and also just how they are fulfilled help them evaluate prospective debtors. Nonetheless, they frequently focus specifically on the private sector of the market. They tend to have economic certifications that are a lot more forgiving than banks.

Have a peek at this website for getting more information related to Property Development Finance.

Commercial Bridge Loans

Get Commercial Real Estate Loans for special purpose properties

With real estate worths increasing across the nation, residential properties detailed today will likely enhance in worth over the following few years. With major loan providers relaxing limitations on Construction Loans, investors have the chance to develop brand-new facilities as well as plan for future cash flow or purchase existing structures to produce instant capital. After making use of a Commercial Real Estate Loans calculator to determine loan payments, the next action in creating a building financial investment plan requires a consider estimated capital as well as projected financial information.

If an entrepreneur wants to acquire the most effective deal in the marketplace place after that they should devote time to investigating the many commercial lenders that are in the market place as well as comprehending the best source of elevating Commercial Finance, comprehending the terms of the item out there along with the lenders' processing demands.

If the principle defaults, the mezzanine lending institution can confiscate on the stock in a matter of a few weeks. If you have the business that has the home, you regulate the residential or commercial property. So a Mezzanine Loan is protected by the stock of a business, which is personal effects as well as can be confiscated much faster. Mezzanine loans depend on cash flow for repayment. Mezzanine financing resembles a bank loan; the main difference is that Mezzanine Loans are safeguarded by a fraction of possession of the project, rather than the real estate.

For Commercial property capitalists, it is necessary to think about the capacity of a Service remortgage. Like household mortgages, commercial mortgages can be re-financed to make use of even more favourable terms, or they can be re-mortgaged to establish a line of credit to utilize for running business. This is also real of Commercial Finance items such as factoring, invoice discounting too. This will permit companies to enhance their margins by decreasing their finance costs, as well as might permit additional revenue for additional investment. This can likewise provide business clients a means to obtain self-reliance from their bank, separating financial obligation from day to day banking plans.

Mezzanine Finance Providers that supply mezzanine financing, generally, offer accordinged to a company's capital rather than a company' properties. Considering that there is little or no security to support the loaning, this sort of financing is priced significantly above safeguarded bank debt. Mezzanine financing is beneficial because it is dealt with like equity on a firm's annual report as well as might make it simpler to acquire common financial institution financing. It is likewise very eye-catching to a company owner as it lowers the quantity of equity dilution, which increases the equity's expected return.

Commercial Bridge Loans are short-lived financing protected by commercial real estate that bridge spaces for you as the debtor that muscle their method between you and your next offer. This kind of commercial funding permits you to prevail over any type of liquidity constraints and take advantage of time-sensitive possibilities in a reasonably timely and efficient way. Commercial bridge loans enable you to gain access to short-term funds that bridge cash flow timing voids enabling you or your Firm to finish some type of acting task. For example, if you have a balloon payment that's coming due on an existing loan, you could deal with that repayment up until you obtain irreversible financing.

Among one of the most valuable functions of a Commercial Real Estate Loans calculator is that entering different worths helps capitalists plan versus the possibility for negative cash flow issues. The difference of just a few portions of a portion point on home loan calculators suggested for residential properties might make a subtle distinction in month-to-month settlement quantities.

Hop over to this website for getting more information related to Commercial Real Estate Loans.

Working Capital Finance

Corporate Loan for banks to lend money to businesses

Corporates risk its capital by taking business choices- the grounds for profit. The risk taking ability is badly stunted in the event of shortage of capital. A stunted danger taking ability has its effects on the future of the corporate home. Money is the lifeblood of any kind of business. As a result, while it will be prudent not making an injudicious use of Corporate Loan, it will neither be useful to starve business of the much needed capital.

Corporate Loan of this form is similar to what is known as a mortgage. The crucial loans that are offered under realty funding include land loan, property growth loan, swing loan for corporates and banker's warranty. Offices as well as factories are an essential asset for the business as all operations are carried out from these place/places. Banks and also banks fund the building and construction or purchase of an already constructed facility through real estate financing.

It is challenging to obtain one when you are not qualified to obtain since when you have your own, where in you need some alternatives to meet and also this are the functioning capital support, tools term loans, long term loans genuine estate growth, loans for real estate proprietors, small company startup loans and also commercial mortgage lending. Normally the bank structures Commercial Lending loans to sustain a range of business purposes and even provide revolving credit lines depending upon business function.

A business could focus on funding a specific kind of business like living centers, medical care business, etc. This type of funding can likewise specialize in offering a type of funding like a temporary funding or it can additionally provide financing of all kinds. Capital Funding is the money that equity owners and also loan providers supply to a business. Debt (bonds) as well as equity (stock) are composed a company's capital funding. This cash is what businesses use to run a capital. The bond and also equity holders are anticipating to gain the return of investment in a form of supply appreciation, rewards and rate of interest. There are numerous firms whose sole function is to give capital funding.

You have this fantastic business idea that you are persuaded will certainly succeed for you. You agree to put in the effort needed to transform your concept into an effective business venture. There is just one catch - the absence of appropriate capital on your component. Nonetheless, you need not despair. There are a few ways out. You could explore all the possibilities clarified listed below to acquire Startup Business Loans as well as select the choice that matches your specific needs best.

Business loan brokers handle both short-term and also long-term loans. Depending upon your possessions as well as credit rating, these loan providers could provide you up. With the cash securely in your hands, you could start buying tools that you need for your business. You could also use it for physical development strategies and enhancement tasks. Applying for a loan from a business loan broker is a very easy task. The standard points that you need are copies of 3 to five years of income tax return and also your individual monetary declaration.

Business Loan Broker are specifically preferred by lots of local business entrepreneurs generally because they hold a friendlier attitude to small businesses compared to banks typically do. A bank can be quick to reject a loan application, whereas a Business Loan Broker will normally reconsider an application because they do not need to worry about regulative restrictions like banks do.

Visit To The Website for getting more information related to Corporate Loan.

Commercial Lending

Tips for Improving Your Working Capital Management

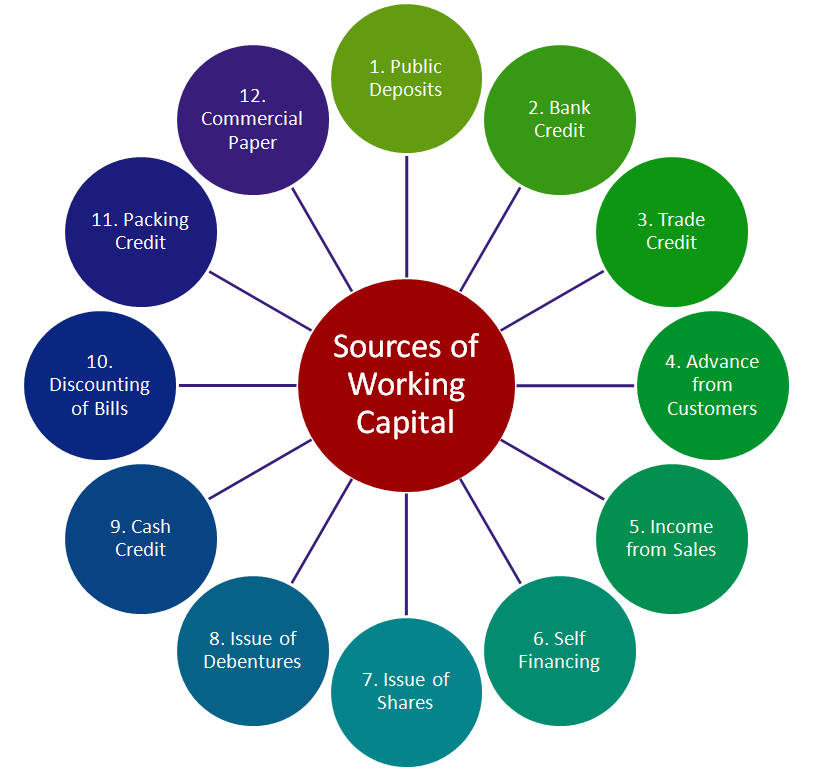

For these factors, working capital policy as well as management is a crucial topic of research study. In numerous text books working capital refers to present properties, and also web Working Capital Management is specified as present assets minus present responsibilities. About 60 percent of an economic supervisor's time is devoted to working capital management, and also most of the prospective staff members in finance-related areas will figure out that their first assignment at work will include working capital.

Working Capital Management choices are separated right into the management of properties (investments) and liabilities (sources of funding), in the long-lasting and also the short-term. It is common expertise that a company's worth can not be made best use of in the future unless it survives the brief run. Companies stop working most often because they are incapable to satisfy their working capital requirements; subsequently, audio working capital management is a requisite for firm survival.

That's why they have to depend heavily on short-term debt services, a lot of which are carefully connected with money financing. Nonetheless, minimal access to equity as well as dependancy on short-term financial debt causes an increase in the demand of a small firm's cash flow, decreases liquidity, as well as expands monetary leverage-all which could lead to an increased financial danger of passing credit.

Working Capital Finance can play a crucial role in addressing this trouble, particularly by putting debt conditions that assure to keep a firm's credit report risk at the lowest. Furthermore, local business may face trouble in increasing temporary debt and not obtaining sufficient assistance to secure the long-lasting debt needed to boost their financial condition and also liquidity, as well as minimize their debt threat.

The actual name Business Capital Loans, says all of it. They are loans that give one with the working capital to keep their service going till it has the ability to base on its feet. This implies that till you can cover all the business expenses out of the profits from your company you are all but protected from the everyday expense. It is a typical reality that a number of organisations fall short since they do not have the benefit of revenue to survive. Working capital funds or loans offer the much necessary cash money to pay the rental fee, earnings of staff members, inventory expenditures, energies, or even the marketing costs amongst various other points.

A correct Inventory Finance is one where you can draw down on a sufficient degree of your inventory worth as well as repaid it as you renew capital by means of account receivable as well as cash collections. Your success in accomplishing an appropriate inventory funding part in your general company funding in effect optimizes your working capital to the degree you have to.

Managing and getting working capital are two different points, as well as worrying about capital financing as well as exactly what kind of loaning and loans are out there is of course one more, and also most likely the concern that worries your firm most. How To Find Working Capital allow's considers some essential problems around sourcing working capital for your service, although we are quite sure our details applies widely. How you have actually handled or are handling your internal financing is straight related to what solutions you have offered.

Check Out The Website for getting more information related to Working Capital Management.

Debt And Equity Financing

Startup Business Loans providing funding to thousands of startups each year

Startup Business Loans are provided to a business owner to start a business which has no or minimum business history. The financial assistance that is provided may be in different forms i.e. in the form of cash, loan or something else. However, there are a lot of people who does not know where to go when it comes to getting the financial assistance. There are also some entrepreneurs that are provided by a lot of options and they find it difficult to decide between them. Visit this site http://www.primefund.com/corporate-funding/ for more information on Startup Business Loans. follow us : https://goo.gl/tD6ae6

https://goo.gl/k9lVbE

https://goo.gl/IAqhTC

https://goo.gl/9GguxM

https://goo.gl/wSzmDc

Acquisition Financing is a common term used within the industry lingo when it comes to the financial aspect of acquiring a company. Acquisition means to acquire or to take something into your possession. This is the layman’s definition of acquisition but in business terms it means when a party acquires enough shares of a company for it to be considered owned by that party. Acquisitions are made as part of a company’s growth plan when it is more advantageous to take over an existing operation than it is to expand. Browse this site http://www.primefund.com/corporate-funding/ for more information on Acquisition Financing. follow us : https://goo.gl/gUacJP

https://goo.gl/hrg9U2

https://goo.gl/mQnrLx

https://goo.gl/Q2GbfD

https://goo.gl/mQnrLx

Debt And Equity Financing are two different financing resources that can be used to finance your acquisition. Debt financing is borrowing money that is to be repaid with interest. It may be in the form of bonds and bills. The people who buy these bonds and bills become lenders and they, in return for their money, become creditors and receive a promised amount. Equity financing is selling your company’s shares to public and generating finance from the money earned by it. Sneak a peek at this web-site http://www.primefund.com/corporate-funding/ for more information on Debt And Equity Financing. follow us : https://goo.gl/pdX0cm

https://goo.gl/9XnDB0

https://goo.gl/7LsE7s

https://goo.gl/0wt6Ro

https://goo.gl/AHNeqU

Commercial Finance

The Mezzanine Loan also enables a business owner to boost up more profits

Business cash advances are literally saving the day for many small business owners because most banks appear to be doing a terrible job of providing commercial loans and other working capital finance help in the midst of recent financial and economic uncertainties. For example, as noted above, restaurants are virtually unable to currently obtain Commercial Finance funding from most banks. Browse this site http://www.primefund.com/commercial-lending/ for more information on Commercial Finance. follow us : https://goo.gl/V5dpKN

https://goo.gl/KbfSWO

https://goo.gl/WA3MI2

https://goo.gl/OZL8eo

https://goo.gl/KI9Ggx

A Mezzanine Loan is normally structured as a bridge between equity and the senior debt. This type of loan structure fills the gap between the two and always provides a chance to the investor to enhance his business. Mezzanine loan is in the lower category, or lower in priority of payment, to the senior loan and is always bigger than the equity. It is the fact that equity is the most important and the expensive source of capital and in this regard a mezzanine loan serves as the best option for investors. Have a peek at this website http://www.primefund.com/commercial-lending/ for more information on Mezzanine Loan. follow us : https://goo.gl/N1Yy7H

https://goo.gl/h6jy7d

https://goo.gl/lYB100

https://goo.gl/spx1WF

https://goo.gl/M9VxWy

The best part about the Commercial Bridge Loans is that they are uncertain. You don’t have to provide any kind of collateral for getting this loan. It is a type of loan that allows you to draw the money up to the credit limit. Any organization may have a lot of payments that are made on daily basis. The amount of money that can be drawn may increase according to the terms and conditions of the agreement. Check Out The Website http://www.primefund.com/commercial-lending/ for more information on Commercial Bridge Loans. follow us : https://goo.gl/8aNLZU

https://goo.gl/1VJ6UV

https://goo.gl/HQF049

https://goo.gl/TJs9ZY

https://goo.gl/W9g575